Turnkey portfolios.

Put our investment insights and fiduciary resources to work for you. Take advantage of curated portfolios that match your clients’ values and goals—while simplifying your investment management.

Filter by:

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

- Broad exposure to U.S. companies

Innovative Technology

A well-diversified portfolio focused on high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology along with increased exposure to risk.

- Broad exposure to future-focused economies in one portfolio

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

- Diversified, relatively low-cost portfolio built for long-term investing

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

- Diversified, relatively low-cost portfolio built for long-term investing

Social Impact

Provides broad diversified exposure with a greater focus on companies actively working toward minority empowerment and gender diversity as part of your long-term strategy.

- Diversified, relatively low-cost portfolio built for long-term investing

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

- Offers higher potential returns along with increased risk

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

- Built to generate a stream of income while mitigating volatility

Cash Reserve

A 100% cash account that earns 5.00% APY (variable)*, carries no-fee on your balance, and is FDIC-insured up to $2 million at our program banks ($4 million for joint accounts)†.

- A secure, FDIC-insured home for your cash at our program banks

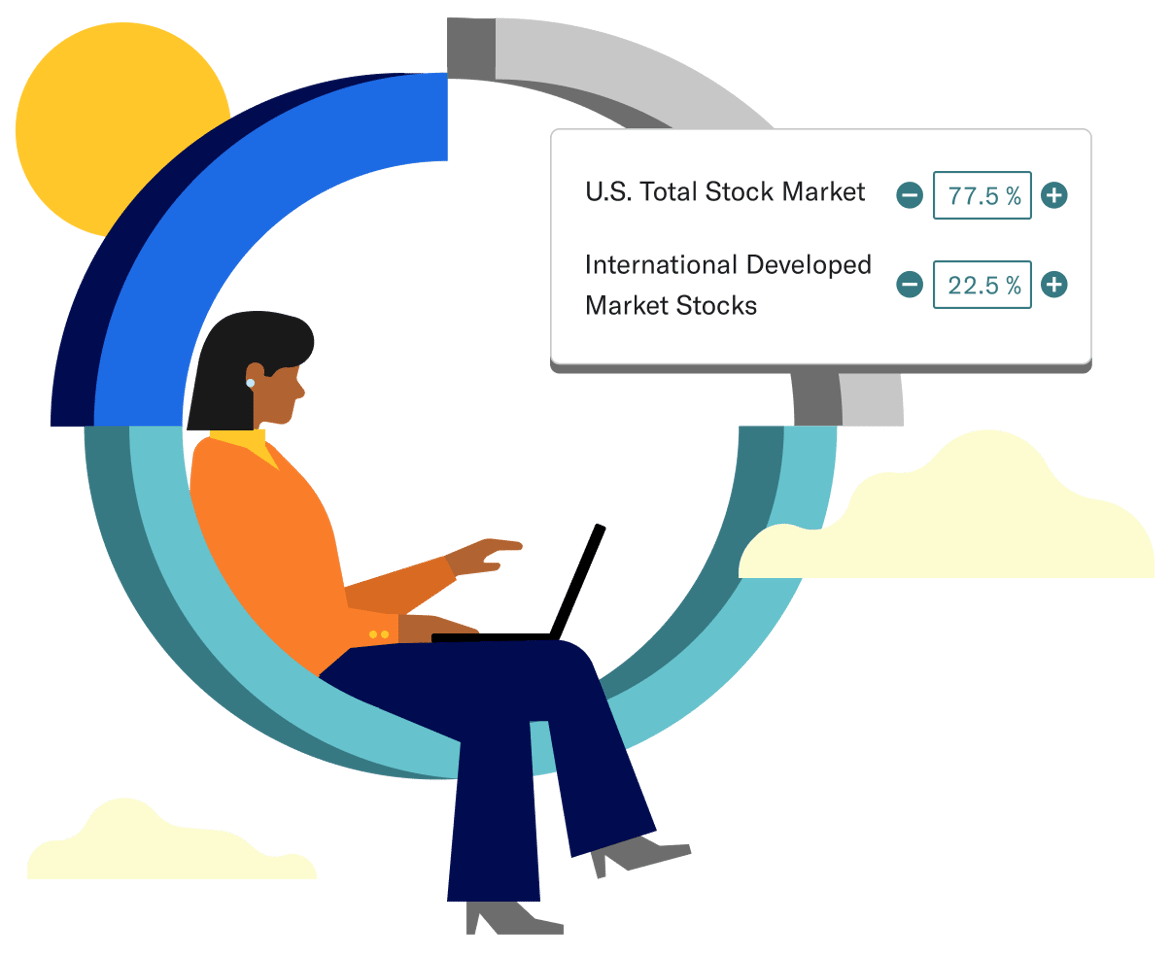

Vanguard portfolio (CRSP Series)

Total return model portfolios seeking to provide broad exposure to U.S. and international equities and U.S. and international investment-grade taxable bonds in an asset allocation framework.

- Broad global diversification with over 19,000 securities available

Universe

Broadly invest in the crypto landscape with one portfolio. Get diversification across decentralized finance, payments, the metaverse, and more.

- Broad exposure to the crypto landscape

Sustainable

Greater emphasis on crypto assets either utilizing less energy to validate transactions or are on a clear path to sustainable energy usage.

- Invests in crypto working towards reducing energy consumption and lower carbon emissions

Bitcoin/Ethereum

Invest in a portfolio of the two largest cryptocurrencies, with approximately 70% in Bitcoin and 30% in Ethereum—reflecting their relative size in the overall crypto market.

- Easy exposure to the crypto market

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

- Stronger focus on potentially undervalued U.S. companies

Your automated investing tools.

-

Smart rebalancing.

Our automated, multi-pronged strategy focuses on tax efficiency while working to ensure that portfolios align with stated objectives.

-

Tax Loss Harvesting+.

Employ automated tax loss harvesting strategies at the flip of a switch designed to minimize tax impact.

-

Tax-coordinated portfolios.

We automate asset location across household accounts to shelter investment growth and help clients keep more of their returns.