The keys to building wealth, whether you rent or buy

There's more than one path to prosperity.

To rent or to buy.

At some point in your life, adulting may very well boil down to this one anxiety-inducing question. But it’s really two questions wrapped in one.

The first is highly-personal: “Which lifestyle is right for me, right now?”

And that answer is totally up to you. It’s largely based on individual circumstance, personal preference, and how much time you can handle at The Home Depot.

But the second question? It deals with dollars and cents, and it’s right up our alley. So we’re here to offer you a sigh of relief, then help you turn hypotheticals into concrete action.

Is renting or buying your primary residence the smarter money move?

We’re in the business of building long-term wealth, and on that topic the historical data is pretty clear: both renting and owning a home can generate large sums of wealth in the long run.

In the case of homeownership, that’s assuming you live there long enough to build equity and recoup the big, additional expenses that come with purchasing and maintaining it.

And with renting, that’s assuming you invest wisely the extra money you would’ve otherwise spent buying and maintaining the home.

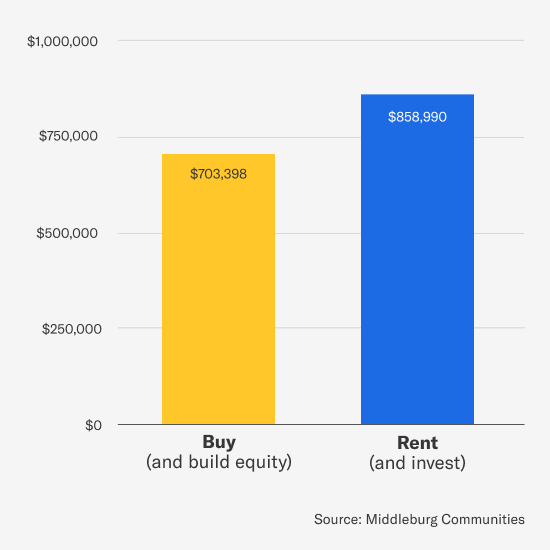

A real estate investment firm recently crunched 50 years of data (see pages 3-5 for all of their assumptions) to see exactly how each hypothetical scenario fared.

Wealth after 30 years

*Data shown is for illustrative purposes only, and is not reflective of any Betterment portfolio or performance. As such, this graph does not reflect any of Betterment’s management fees, transaction costs or fund expenses.

Renting slightly edges out buying in this study, although a buyer with a paid-off home could arguably close the gap in subsequent years if they invest their old mortgage payments.

But these nitpicks miss the point, because in terms of wealth, both people are doing just fine in this hypothetical. So let’s all take a moment to exhale, because you can do well no matter which path you take.

In the case of renting, it just requires you to actually invest those savings and not spend them. And we can help with that.

How to realize the potential of “renting + investing”

Let’s use the median house in America as an example. It costs roughly $415,000.

Here’s a rough approximation of how much money you would need, both up front and ongoing, to buy and maintain it. Keep in mind the ongoing costs listed below exclude the mortgage payment itself.

|

Up-front expenses |

Amount |

|

Downpayment (20%) |

$83,000 |

|

Closing costs (2%) |

$8,300 |

|

Agent commission* (3%) |

$12,450 |

|

Total |

$103,750 |

|

Ongoing expenses |

|

|

$484 |

|

|

$179 |

|

|

$534 |

|

|

Total |

$1,197/month |

Pay attention to your emotions here, because they can help guide your decision making. If you can’t imagine saving and investing this much money right now, then you may struggle to afford owning the median U.S. home.

And that’s okay! One's answer to the Rent vs Buy question may very well change multiple times throughout life.

Just remember you can still build wealth while renting. Crunch the numbers above based on your own budget, then follow two steps to see the strategy through to the end:

- Start saving for those upfront costs now.

- Once you have that amount in hand, start investing the equivalent of those monthly non-mortgage costs via recurring deposit.

Now it’s no longer a hypothetical. You’re putting those savings to work. Should you decide to buy down the road, you’ll be more financially ready—and the tradeoff will be clear as day:

Buy a house. Or keep saving at your current levels.

There’s no wrong answer here. Whatever you decide will be the right decision for you. And it’ll be an informed one.